Life Cycle Assessment: A Tool to Strengthen ESG Disclosures

As ESG reporting requirements in India grow more rigorous, companies are under pressure to accurately quantify their environmental impacts. Beginning FY 2025–26, SEBI’s BRSR framework will mandate the top 250 listed companies to report ESG data from key value chain partners.

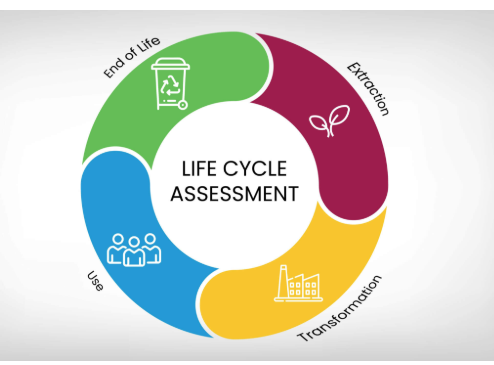

In this evolving landscape, Life Cycle Assessment (LCA) emerges as a critical tool for evaluating environmental performance across a product’s entire journey from raw material extraction to end-of-life disposal. By identifying impact hotspots and quantifying resource use and emissions at each stage, LCA equips companies to make informed sustainability decisions, meet regulatory expectations, and strengthen ESG performance.

Understanding Life Cycle Assessment

LCA is a scientific method used to evaluate the environmental impacts of a product throughout its entire life cycle. This includes stages from raw material extraction and manufacturing to distribution, use, and final disposal though the exact scope depends on the type of LCA performed. By measuring inputs (such as energy, water, and raw materials) and outputs (including emissions, pollution, and waste) at each stage, LCA pinpoints where environmental impacts are most significant.

LCA follows international standards namely ISO 14040 and ISO 14044, ensuring assessments are consistent, transparent, and credible, providing reliable insights to support informed decision-making.

Types of Life Cycle Assessment

Life Cycle Assessment (LCA) can be conducted at different stages of a product’s life cycle, with each approach serving distinct purposes. The choice of which type to use depends on the goals and focus areas of the company. The four main types are3:

1. Cradle-to-Grave: Assesses the full life cycle from raw material extraction to final disposal (e.g., landfill or incineration). Offers a complete view of a product’s environmental footprint.

2. Cradle-to-Cradle: Similar in scope to Cradle-to-Grave but designed for circularity. Focuses on reusing or recycling materials to create closed-loop, zero-waste systems.

3. Cradle-to-Gate: Covers environmental impact from resource extraction to the point the product leaves the factory. Useful for manufacturers optimizing early-stage processes.

Stages of LCA

Conducting an LCA involves four key stages, as defined by ISO 14040 and ISO 14044 standards2, 4 :

1. Goal and Scope definition

This stage defines:

- The goal: Why the LCA is being conducted.

- The scope: The boundaries of the study, such as cradle-to-grave (the entire life cycle of a product) or cradle-to-gate (up to the production stage)

- Functional unit: A measurable unit to quantify the product’s performance.

2. Life Cycle Inventory Analysis (LCI)

This phase involves collecting data on the following:

- Inputs: Materials, energy and water used during production.

- Outputs: Emissions to air, water, soil and any waste generated in the process.

3. Life Cycle Impact Assessment (LCIA)

- In this stage, data is reviewed to estimate the environmental effects within the framework of Global Warming Potential (GWP), ozone depletion, acidification, and resource depletion. This step gives the weight of the environmental load for each phase and provides greater insight into where a product is likely to have the most impact.

- It assists the businesses in realizing the compromises made at this stage. Optimizing for environmental impact in one phase of the production cycle may therefore come at a cost in another phase. This means that companies have to strategically decide where to focus to minimize their impacts.

4. Interpretation

The results of the assessment are then analysed to:

- Identify environmental hotspots i.e. areas with the highest impact

- Propose recommendations for improvement

- Validate findings to ensure they align with the original goals.

Why Companies Conduct Life Cycle Assessment?

Life Cycle Assessment (LCA) enables companies to make sustainability-driven, data-backed decisions. Here’s how it helps:

i. Spot environmental hotspots: Identify which life cycle stages contribute the most to environmental impact. For instance, Coca-Cola’s LCA showed packaging as a major emission source, leading to plant-based, recyclable bottles.

ii. Improve product design and resource efficiency: Optimize materials, manufacturing, and logistics to reduce environmental footprint. For example, Apple uses LCA to monitor ecological impacts and aims to use 100% recycled aluminum in its products. Also, Nestlé redesigned its coffee pods to be fully recyclable based on LCA insights4.

iii. Guide strategic decision-making: Provide leadership teams with clear insights to avoid rebound effects, focus on high-impact interventions, and strengthen sustainability across supply chains.

iv. Enhance brand credibility and stakeholder trust: Transparent, science-based environmental improvements help build trust with customers, investors, and other stakeholders. As investors increasingly prioritize environmental performance, companies with strong LCA practices gain a competitive edge.

Benefits of LCA

As ESG evaluations evolve to demand more rigorous, data-driven insights, companies that incorporate LCA into their sustainability strategies stand to benefit from more credible and comprehensive environmental assessments.

1) Quantitative Environmental Metrics: LCA provides detailed, quantifiable data on environmental impacts, covering carbon emissions, water and energy use, material consumption, and waste generation, across all life cycle stages. This granularity supports more accurate and meaningful ESG disclosures.

2) Improved Data Quality and Transparency: ESG ratings often rely on publicly disclosed data, which can vary in quality and consistency. LCA enhances the reliability of environmental disclosures by grounding them in internationally recognized methodologies and system boundaries.

3) Demonstrated Environmental Stewardship: Companies conducting LCAs showcase a proactive approach to identifying and addressing environmental hotspots. This signals a deeper operational commitment to sustainability beyond surface-level reporting.

4) Regulatory Readiness and Risk Management: As global regulations move toward lifecycle-based disclosures—such as the EU’s Digital Product Passport and Carbon Border Adjustment Mechanism—companies leveraging LCA position themselves ahead of compliance requirements. This future-readiness is often rewarded in ESG risk and opportunity assessments.

5) Investor Confidence: As institutional investors sharpen their focus on environmental performance, decision-useful, verifiable data from tools like LCA helps build trust. Companies able to back their sustainability claims with lifecycle-based evidence are more likely to be viewed as low-risk, forward-thinking investments.

The value of integrating LCA into ESG strategies lies in its ability to provide a detailed and systematic understanding of environmental impacts. As ESG disclosure requirements evolve companies adopting LCA are better prepared to provide transparent, credible data that reflects their true sustainability performance.

Conclusion: The Strategic Edge of Embracing Life Cycle Assessment

Life Cycle Assessment is more than just an environmental accounting tool, it’s a strategic asset in today’s evolving ESG landscape.

As expectations from regulators, investors, and stakeholders grow, companies that adopt LCA will be better positioned to deliver transparent, credible sustainability outcomes. By understanding and managing environmental impacts across product life cycles, businesses can reduce risks, improve efficiencies, and strengthen their market reputation.

For Indian enterprises aiming to stay competitive and responsible in a global market, embedding LCA into sustainability practices is becoming a vital step not just to comply but to lead.

References:

- https://cleartax.in/s/brsr-reporting

- https://www.zevero.earth/blog/what-is-life-cycle-assessment-lca

- https://www.optelgroup.com/en/blog/what-is-a-life-cycle-assessment-lca/

More News

ESG Frameworks and Why They Matter: A Rating Provider’s Perspective

An in-depth overview of key global and regulatory ESG frameworks, explaining how...

UK Proposes Regulation of ESG Ratings to Strengthen Market Trust

The UK proposes formal regulation of ESG rating providers to address transparenc...

Double Materiality Assessment and its Significance

This blog explains the concept of Double Materiality Assessment and why it is be...

How Independent Reviews Enhance Investor Confidence in ESG Debt Markets

SEBI’s 2025 ESG debt framework marks a new phase for India’s sustainable fin...

GHG Protocol x ISO: A New Partnership to Align Global Carbon Accounting

A major shift in corporate climate reporting is underway as the GHG Protocol and...