#SEBI Accredited Independent Reviewer/ Certifier of Social & Sustainability-linked bonds in India

Who We Are

We are a SEBI-accredited Independent Reviewer/Certifier for Social Bonds & Sustainability-linked Bonds (SLBs). Our assessments are conducted as per SEBI’s regulatory framework and under the ICMA guidelines.

What We Offer

Our core services are structured to support bond issuers through every stage of the Bond process:

1. Social bonds

A Social Bond is a type of bond where the money raised is used only to fund or refinance eligible Social Projects. These bonds must abide by the four core components of the Social Bond Principles (SBP), as defined by ICMA, as mentioned below:

1.1 Second-party opinion

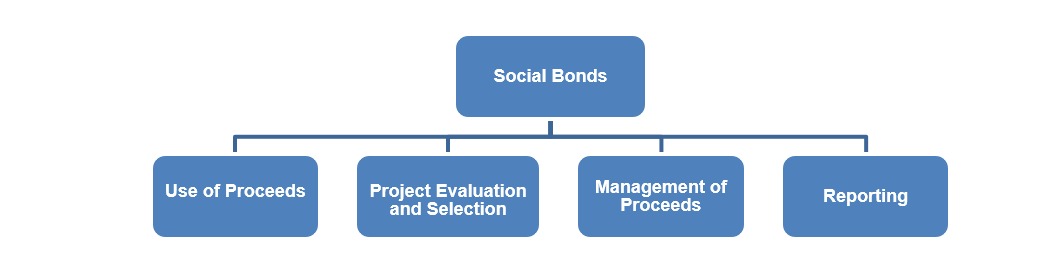

Chart 1: Social Bonds Framework

The Social Bonds framework is based on four principles: Use of Proceeds, Project Evaluation and Selection, Management of Proceeds and Reporting.

As per SEBI’s guidelines, we act as an independent third-party reviewer with expertise in the environmental, social and sustainability domain. We provide Second Party Opinions for Social Bonds, assessing whether the issuer’s framework aligns with the core components of ICMA’s Social Bond Principles or other relevant standards. The evaluation also considers the issuer’s overall social objectives, strategy, policies and processes to ensure consistency with its stated social sustainability goals.

1.2 Certification

An issuer may have its social bond, the associated Social Bond Framework, or Use of Proceeds certified against a recognized external social standard or label. As per SEBI guidelines, we act as an independent third-party certifier for social bonds, ensuring alignment with the ICMA Social Bond Principles or other relevant standards.

1.3 Verification

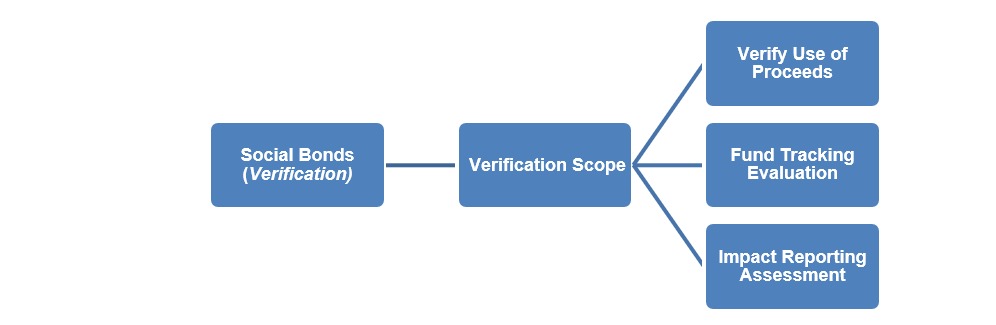

Chart 2: Social Bonds Verification Framework

The Social Bonds verification framework covers three areas: Verifying Use of Proceeds, Fund Tracking Evaluation and Impact Reporting Assessment.

Verification involves assessing alignment with internal or external standards or specific claims made by the issuer. It may also encompass an assessment of the social characteristics of the underlying assets, with reference to recognized external criteria. Additionally, verification can include assurance or attestation of the issuer’s internal processes such as the tracking of use of proceeds, allocation of funds, reported social impact and the consistency of reporting with ICMA’s Social Bond Principles or other relevant standards.

2. Sustainability-Linked Bonds

Sustainability-Linked Bonds (SLBs) are bonds where the financial terms vary depending on whether the issuer achieves predefined sustainability or ESG goals. These goals are tracked through Key Performance Indicators (KPIs) and evaluated against Sustainability Performance Targets (SPTs) within a specified timeline. ICMA, in its guidelines for Sustainability-Linked Bonds, has outlined five key components with which SLBs must be aligned:

2.1 Second-party opinion

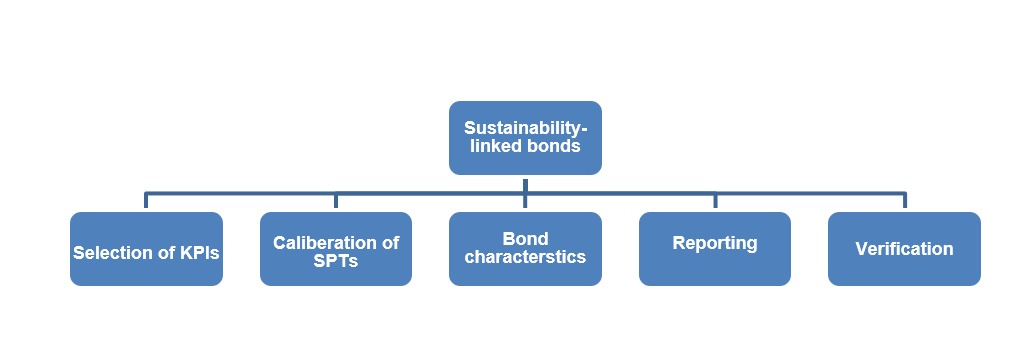

Chart 3: Components of Sustainability-Linked Bonds

This chart shows the five key components of Sustainability-Linked Bonds: Selection of KPIs, Calibration of SPTs, Bond Characteristics, Reporting and Verification.

As per SEBI’s guidelines, we act as an independent third-party reviewer with expertise in the environmental, social, and sustainability domain. We provide Second Party Opinions for Sustainability-Linked Bonds (SLBs), assessing whether the bond’s framework aligns with the core components of ICMA’s Sustainability-Linked Bond Principles or other relevant standards. The evaluation includes a review of the issuer’s selected Key Performance Indicators (KPIs), Sustainability Performance Targets (SPTs) and related strategy, policies, and processes to ensure the credibility of its sustainability commitments. The review is conducted independently from the issuer and its advisers, with appropriate safeguards in place to maintain objectivity and transparency. Additionally, issuers are encouraged to seek external review (such as an updated second-party opinion) to comment on their progress against their benchmark and if external benchmarks have changed after the adoption of the SLB framework.

2.2 Certification Services for SLBs

An issuer may have its sustainability-linked bond, the associated Sustainability-Linked Bond Framework, or specific elements such as Use of Proceeds, selected Key Performance Indicators (KPIs) and Sustainability Performance Targets (SPTs) certified against a recognized external sustainability standard or label. As per SEBI guidelines, we act as an independent third-party certifier for sustainability-linked bonds, ensuring alignment with the ICMA Sustainability-Linked Bond Principles.

2.3 Verification (Post Issuance)

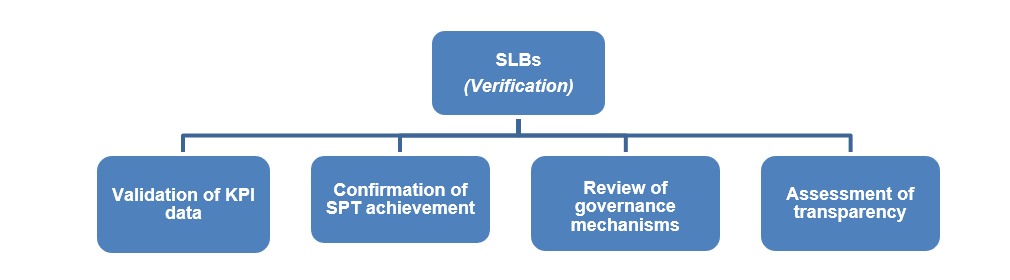

Chart 4: Post-Issuance Verification of Sustainability-Linked Bonds

This chart highlights the key aspects of post-issuance verification for Sustainability-Linked Bonds: Validation of KPI data, Confirmation of SPT achievement, Review of governance mechanisms and Assessment of transparency.

For Sustainability-Linked Bonds, post-issuance verification is a requirement under ICMA’s Sustainability-Linked Bond Principles (SLBPs). Issuers are expected to obtain independent, external verification (such as limited or reasonable assurance) of their performance against each Sustainability Performance Target (SPT) for the selected Key Performance Indicators (KPIs). This verification must be conducted at least annually and for any date or period relevant to assessing SPT achievement, particularly where performance may trigger a change in the bond’s financial or structural characteristics.